Navigating the SBA 8(a) Data Call: Key Documents & Our Free Compliance Checklist

UPDATE January 22, 2026: SBA suspended over 1,000 contractors from participation in the 8(a) Program after they failed to submit the documents SBA requested in December. News Release.

UPDATE December 19, 2025: SBA is extending the due date to upload this information until January 19, 2026. They have also provided an SBA 8(A) Data Call - FAQs page.

On December 5, 2025, the U.S. Small Business Administration (SBA), Office of General Counsel, announced that it issued letters to all 4,300+ 8(a) Business Development Program participants requiring submission of financial records covering the last three fiscal years as part of an effort to identify and address fraud, waste, and abuse.

The submission deadline is January 19, 2026, and the SBA warns that failure to respond may result in loss of 8(a) program eligibility and possible further investigative or remedial action.

Why This Data Call Is So Important

This is not a routine annual update. The SBA characterizes this as part of a broader, agency-wide review of the program, with heightened scrutiny on participant compliance and supporting documentation, and the notice makes clear that non-response can put a firm’s continued participation at risk.

Practically, firms should treat this as an audit-level production. A strong submission should be:

- Complete

- Traceable

- Internally consistent

- Reconciled across financials, payroll, banking support, and contract files

In short, this is the type of request where gaps, inconsistencies, or missing support can trigger follow-up scrutiny, while a clean, well-supported package helps reduce risk and avoid preventable disruption.

What SBA Is Requesting

Based on the official SBA announcement and the letter issued to participants, SBA is requesting three closed fiscal years of core business records, including:

Financial and Accounting Records

- General ledger

- Trial balances

- Financial statements

- Sub-ledger schedules supporting A/R, A/P, and P&L accounts

- Reconciliations tying financial statements to year-end balances

Banking Support

- Year-end bank statements

- Year-end bank reconciliations

Payroll and Employment Records

- Payroll registers and payroll reconciliations (including owner distributions)

- Employee listings, including employees mapped to contracts supported

Contracting Documentation

- Copies of 8(a) contracts currently being performed

- Subcontracting agreements tied to those contracts

- Vendor lists and joint venture listings

Submission Method

- The letter instructs firms to upload the requested items through the MySBA Certifications portal.

SBA Exhibit A Compliance Checklist

To assist you, we’ve created a free SBA Exhibit A Compliance Checklist to help you understand what’s required and stay organized.

💡 Did you know?

The SBA letter notes that if you already provided certain items in your routine annual 8(a) reporting, you may not need to submit those same items again, but you should confirm what’s already on file before uploading duplicates.

The Role of Your Accounting System and Why It Matters Now

One of the biggest challenges with a request of this scope is not whether the data exists, but whether it can be produced quickly and cleanly in a way that ties out.

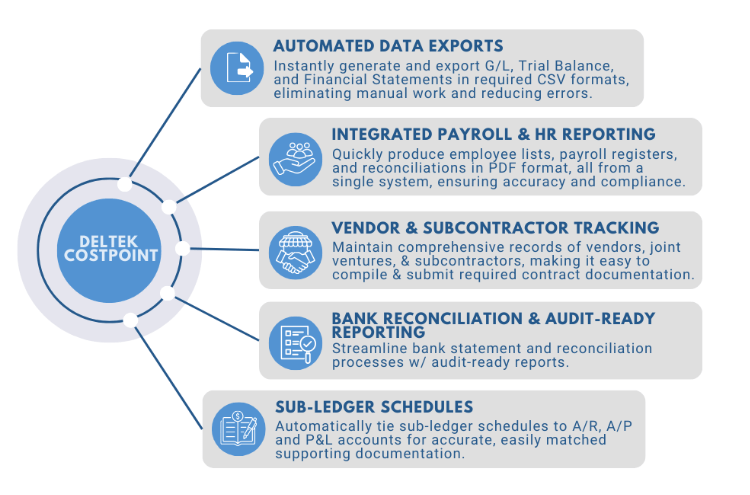

Firms running purpose-built government contracting systems for example, Deltek Costpoint are often better positioned because these systems help support:

If your current environment is a mix of spreadsheets, bank feeds, and basic accounting software, this kind of three-year lookback can quickly become an urgent fire drill, especially when you need traceability from:

- Source documentation

- To ledgers and sub-ledgers

- To reconciliations and supporting schedules

Being on a government-contractor-focused accounting system like Deltek Costpoint can make a major difference in situations like this, because the platform is built to produce consistent, traceable, and reconcilable financial and contract reporting without relying on manual workarounds.

Iuvo Systems is a certified Deltek Costpoint Reseller. If your current system isn’t set up for federal compliance expectations, we can help:

- Evaluate system fit and readiness

- Plan a transition to a more compliant accounting environment

- Implement Costpoint in a way that supports audit-ready reporting and stronger internal controls

How Iuvo Can Help

Iuvo Systems understands the scope, the pressure of the deadline, and the level of documentation SBA expects to see in a submission that can withstand review.

Iuvo Systems specializes in outsourced accounting and federal compliance for government contractors, including FAR, CAS, DCAA readiness, Costpoint/ERP support, and audit preparation.

Our team can assist with:

- General ledgers, trial balances, and financial statements

- Reconciled sub-ledgers (AR, AP, and P&L)

- Payroll registers and owner distributions

- Contract files, subcontract documentation, and vendor listings

- DCAA-aligned reporting packages

- Audit-ready schedules that tie back directly to your accounting system

- Identify gaps and reconciliation issues

- Build a clean, submission package ahead of the January 5, 2026 deadline

We’ll help you confirm what’s needed, close gaps quickly, and deliver a submission ahead of the January 5, 2026 deadline.

Explore our full services.

Iuvo means “to help and to support” in Latin. True to our mission of being a trusted partner in the success of government contractors.

About Iuvo:

Iuvo Systems is a certified 8(a) and Minority Business Enterprise (MBE) small business with over 16 years of experience specializing in outsourced accounting & financial services, data analytics & reporting, enterprise system solutions, and GovCon staffing solutions for government contractors and agencies. Iuvo Systems provides expertise in all aspects of Government Contracting, DCAA, FAR, and CAS. We are headquartered in Washington DC metro area with an office in Atlanta, GA. We proudly serve clients across the nation and extend our expertise to support operations outside the continental United States (OCONUS).